Blog

Consolidating your pensions – is it a good idea?

Jenny is a 47-year-old Account Manager with a long and varied CV. She hasn’t quite had more jobs than hot dinners but, when she thinks about the various pensions she’s acquired over the years, sometimes it feels that way. Jenny has recently been considering consolidating pensions. But is combining her pensions necessarily the best way […]

Do you keep meaning to sort out your will? We can help you.

Life is busy, we get it. But is anything more important than being in control of your future? Recent research* suggests that only 44% of UK adults have made a will, which means that you’re far from alone if you haven’t yet got around to completing what, for some, appears to be a daunting task. […]

What is a Lasting Power of Attorney (LPA) and do I need one?

A Lasting Power of Attorney (LPA) is a legal document that allows you to appoint one or more people to make decisions on your behalf during your lifetime. The people you appoint to manage your affairs are called the attorneys. An LPA is a completely separate legal document to your will although many people put […]

How to Maximise Your Pension Contributions to Secure your Financial Future

Maximising pension contributions is crucial for securing your financial future. By leveraging tax benefits and participating in retirement plans, you can increase savings and take advantage of employer matching programs. Catch-up contributions near retirement can significantly boost savings. Start early to accumulate wealth and pave the way for a stress-free retirement. Understanding Pension Contributions Pension […]

Our Monthly Newsletter – March 2024

Welcome to the Downton and Ali Investment Insights Newsletter for March 2024. In this edition, we talk about the benefits of starting a pension early, and investment strategies as you approach retirement, and more. Click here to read the newsletter.

Support your family finances: Last minute tax year tips

As we approach the end of the tax year, there’s still time for you to support your family finances, and ensure you use your allowances in an efficient manner. Kick start your child’s financial future Saving for your children’s future is a huge responsibility, although a rewarding one. To give your child a head start […]

Preparing for retirement: the road to financial freedom

Retirement isn’t just about sipping cocktails on a beach; it’s about having the financial security to do so. Fortunately, there are plenty of ways to pave your way to financial freedom when it comes to your time to retire. However, it requires you to put in the work as the amount of money you need, […]

Spring Budget 2024: Winners and Losers

At 12.30pm today, Chancellor of the Exchequer Jeremy Hunt announced the UK Spring Budget, as well as the economic and fiscal forecast by the Office of Budget Responsibility. These legislative announcements are game-changers for Britain’s economy, and Hunt’s announcements included a number of sweeping changes that could potentially affect the personal finances of everyone living […]

As we approach the end of the tax year, it’s a good time to start thinking about how to make the most of the tax reliefs and allowances you’re entitled to, before they are lost. We’ve put together a checklist to ensure you’re aware of all the ways to make sure you don’t miss out. […]

Our Monthly Newsletter – February 2024

Welcome to the Downton and Ali Investment Insights Newsletter for February 2024. In this edition, we’re talking about the latest news in Junior ISAs, busting some investment myths, investment strategies to consider approaching retirement and the effect of psychology on investors. Click here to read the newsletter.

Investing in Stocks and Shares ISAs

Investing in a Stocks and Shares Individual Savings Account (ISA) can be an excellent way of growing your wealth over the long term, providing the potential for higher returns compared to other forms of savings. This post aims to demystify stocks and shares ISAs, explaining how they work, the risks involved, and the potential benefits. […]

Some techniques to think about when you’re investing

Whether investing for the first time or looking to improve your approach, a good place to start is with the people who do this for a living. Here are four techniques the professionals follow that could help you become a successful investor. Think Long Term History shows that patience and commitment tend to reward investors, […]

Key dates for your finances in 2024

As we say goodbye to 2023 and welcome 2024, now’s the perfect time to make sure you’re fully prepared for the financial year ahead. To make it easy, we’ve summarised the key financial dates to put in your diaries: January 1st – New Energy Price Cap – The new energy price cap for the next […]

The essentials you need to know about credit checks before borrowing money

The information a lender finds during a credit check is important – it could affect whether you’re able to borrow money, including through a mortgage, and the interest rate you’re offered. Yet, they can also seem perplexing. Indeed, a Royal London survey found that a third of Brits had never looked at their credit report. […]

Is It Worth Building an Investment Portfolio in an Economic Downturn?

In the face of an economic downturn, many individuals are left questioning the wisdom of investing. The declining market values and financial uncertainties can make the investment landscape seem fraught with danger. However, building an investment portfolio during such times may not be as counterintuitive as it first appears. This article aims to shed light […]

Cancelling your financial protection could be a dangerous way to save money

While the cost of living crisis may be putting a strain on your finances, read why cancelling your financial protection could be a dangerous way to save money Centuries ago, Benjamin Franklin said that… “By failing to prepare you are preparing to fail.” This is especially true when it comes to ensuring your personal finances […]

Five practical ways to protect your money during the cost of living crisis

With inflation at its highest level in 41 years and energy prices skyrocketing, the cost of living crisis has dominated headlines since inflation began to creep up from historic lows in mid-2021. While the Covid pandemic began the inflationary increase, this was further exacerbated by the war in Ukraine pushing up energy and food prices […]

Understanding Life Insurance: A Guide to Coverage Essentials

When it comes to safeguarding your family’s financial future, life insurance can be a valuable tool. It’s a subject that might seem complex and even intimidating at first glance, but don’t worry, we’re here to make it easier for you. In this guide, we at Downton & Ali aim to break down the basics oflife […]

The 2023 Autumn Statement: Winners and Losers

UK Chancellor Jeremy Hunt’s 2023 Autumn Statement outlined, in his words, “eight months of hard work” and no fewer than 110 measures to help grow the British economy. Contained within are a raft of measures set to overhaul everything from minimum wage and benefit payments to tax, business investment, and more. The Winners Young and […]

What are value-added services?

Value-added services are benefits included in an insurance policy that you might not be aware of – but could help improve your overall health and wellbeing. When you take out an insurance plan like life insurance, critical illness, or income protection, you get the financial protection in the form of a payout, but there are […]

Understanding Critical Illness Cover: A Lifeline for When You Need it Most

Critical illness cover, an insurance policy that provides financial support should you be diagnosed with a specified illness or medical condition, can be a financial lifeline for families during challenging times.The unpredictability of life makes it worth considering, as it provides a sense of certainty in an otherwise uncertain situation. This article will break down […]

The cost of living crisis is causing many to re-evaluate the benefits of financial advice

Traditionally, the value of financial advice has been measured by monetary results of investment performance and returns. Today, the cost of living crisis is causing many to re-evaluate the benefits of financial advice. These days, financial planning is about more than simply looking after your money and protecting your wealth. As well as helping you […]

Income protection – one little change you can make to protect your family’s financial future.

As a parent, providing for your children is a top priority – from making sure they have food on the table, to ensuring they have the extras they need in life. Putting income protection in place means you’ll always be able to support your children with a regular income if the unthinkable should happen and […]

A little change you can make today can safeguard your biggest investment – your home

If you’re a homeowner, your mortgage payments are likely to take up a large part of your income each month. But if you became seriously ill or injured, and unable to work, would you be able to keep up your mortgage repayments? As buying a home is likely to be your biggest investment, it pays […]

Securing Your Future: Understanding Income Protection

In an unpredictable world, it is crucial to safeguard our financial future against unforeseen circumstances. Income protection is instrumental in ensuring you and your family aren’t left in the lurch if you’re unable to work due to illness or injury. Let’s take a look at the basics of income protection and why you might need […]

Protection policies aren’t just there for when things go wrong. Many protection insurers include access to a range of health and wellbeing support services – and you don’t need to claim to be able to use them. These services can make everyday life that little bit easier. From knowing you can have immediate professional support […]

More than a decade of auto-enrolment

Since the government introduced pension auto-enrolment in 2012, millions more workers have started saving for their retirement. Now, the government has confirmed plans to extend auto-enrolment to encourage a savings boost. The changes could have implications for both employees and business owners. Following a review of auto-enrolment the government has revealed key reforms forecast to […]

Being self-employed can be a rewarding and fulfilling career choice, allowing freedom to work to your terms and pursuing passions. However, it also comes with its challenges, one being financial insecurity. Unlike those working within a company, if you’re self-employed you are responsible for your own financial stability. This means taking the necessary steps to […]

How Vitality Health Plans and Employee Benefits Impact Your Company’s Success

In today’s competitive business landscape, offering a comprehensive employee benefits package is crucial to attracting and retaining top talent. One such benefit that has gained significant traction among UK business owners is the Vitality health plan. This unique health insurance option not only provides employees with extensive Vitality health cover but also encourages a healthier […]

The cost of living crisis is causing many to re-evaluate the benefits of financial advice

Traditionally, the value of financial advice has been measured by monetary results of investment performance and returns. Today, the cost of living crisis is causing many to re-evaluate the benefits of financial advice. These days, financial planning is about more than simply looking after your money and protecting your wealth. As well as helping you […]

Safeguarding Your Business: The Importance of Key Person Protection

In today’s competitive business landscape, the success and growth of a company often hinge on the contributions of key individuals. These indispensable team members can make all the difference in driving innovation, generating revenue, and keeping operations running smoothly. But what happens when the unexpected occurs and you suddenly lose one of these crucial assets? […]

3 useful ways to manage your finances and boost your financial wellbeing

The cost of living crisis has dominated the headlines since inflation began to creep up from historic lows in mid-2021. While the Covid pandemic began the inflationary increase, the situation was made worse by the war in Ukraine, which pushed up energy and food prices even further. Following such an extended period of price rises, […]

Being self-employed can be a rewarding and fulfilling career choice, allowing freedom to work to your terms and pursuing passions. However, it also comes with its challenges, one being financial insecurity. Unlike those working within a company, if you’re self-employed you are responsible for your own financial stability. This means taking the necessary steps to […]

Life after your Fixed Rate mortgage. Should you stay with your lender?

Staying with your current lender may feel like the saftest option when your mortgage comes to an end, but that’s no guarantee that you’ll be getting the best deal. That’s why we recommend shopping around to get a mortgage that’s fits you. When there is such uncertainty in the housing market at the moment, you […]

Life after your Fixed Rate mortgage. Should I remortgage when my fixed rate ends?

The short answer? Yes. If you don’t remortgage at the end of your term, you will be automatically transferred to your lender’s standard variable rate, which tends to be higher than the rates on most other mortgage options.* So if you’re coming to the end of your fixed rate mortgage deal, it’s worth shopping around […]

The Pros and Cons of Relying on the Bank of Mum and Dad

It’s no secret that the bank of mum and dad is a popular source of financial help for young people buying their first home. A recent study by Legal & General showed that a whopping 71% of millennials receive support from their parents when buying property. Let’s examine the pros and cons of relying on […]

Life after your Fixed Rate mortgage. What happens when your mortgage deal expires?

If the end of your fixed rate mortgage is on the horizon (even if it’s months away), then it’s a good idea to start looking at your options today. If you haven’t got a new deal in place when your fixed rate mortgage ends, your lender will put you onto their standard variable rate, which […]

Can your energy efficient home help save money on your mortgage?

Have you ever heard of a green mortgage? They’re steadily becoming a popular option for property owners, as many lenders are adding them to their portfolios. If you’re due to remortgage soon and you have an energy efficient home, it’s well worth considering them as a remortgage option. We explore what they are and how […]

First-time buyers guide to saving for a house deposit

When preparing to buy your first home, saving for a deposit can be a difficult process. As house prices, inflation and the cost of living increases, it can be challenging trying to save a large sum of money. It’s also important to consider all the other costs that are involved in buying a property – […]

What is Shared Ownership and Is It Right for You?

Shared ownership is a government scheme introduced to help people get onto the property ladder. It can be an affordable way for people to buy a home, and potentially a great option for those who cannot afford a property outright. In this blog post, we will look at what shared ownership is, how it works, […]

The Value of Mortgage Advice from a Financial Adviser

Harry and Sam have been staying with Harry’s dad in his two-bedroomed terrace for just over a year while they save up a deposit for their first house. The lack of space and privacy has proved challenging to say the least and would now like to start searching for their own house. Despite having saved […]

With over 10 years of record low interest rates, fixed rate mortgages offer borrowers the stability of knowing what the mortgage payment will be for a set period, which helps with budgeting. Because of the way many lenders decide what rates to offer, we’re currently seeing tracker products priced a lot more competitively than fixed […]

How to improve your chances of passing a mortgage affordability assessment

Getting on the housing ladder can feel like one of the hardest and longest processes in the world and the cost of living crisis is probably not helping. You need to come across as attractive buyers for lenders to consider you, but there are many factors that can reduce how much lenders are willing […]

Don’t Let 2023 Catch You Off Guard – Reevaluate Your Mortgage Rate

If you have a mortgage rate coming up for renewal this year, it is essential to start planning early. Don’t let yourself get blindsided by the rate increases. Having a mortgage review is a key part of ensuring you are in control of your finances when your current mortgage deal is ending. A financial adviser […]

Start of the tax year checklist

The new tax year on 6 April 2023 is a great time to review your finances. The new tax year means annual allowances are reset and ready to be reused – to help you make the most of your money. This year more than ever, with interest rates and inflation on the rise, it’s […]

Why having an emergency fund matters and where to hold extra cash reserves

Having ready cash on hand is an essential part of any successful financial plan. When investing, it’s important to hold an emergency fund. This readily available cash will mean you’re prepared to protect yourself against the unexpected and also plays a vital role in maintaining your financial wellbeing. It’s generally advised to keep between three […]

Make the most of your tax wrappers

It’s a good idea to know how your investments are taxed when selling them. Here are some of the ways you can organise your assets to make them tax efficient. One of the worst things about earning money is that you have to pay tax. Whether it’s your salary or the interest you’ve earned on […]

The start of a new year is a great time to review your finances – whether it’s your savings and investments, mortgages or insurance policies. Higher interest rates and the rapid increase in the cost of living are likely to be affecting many areas of your finances. The start of the year is the perfect […]

Everything You Need to Know About ISA Transfer Rules

ISA transfer rules can be confusing for savers. In this blog post, we will break down these rules and explain how they work. We will also discuss what you need to know before transferring your ISA to another provider. What is an ISA transfer? Moving your savings with an ISA transfer is a great way […]

Inflation explained – why is it so high and how could it affect you?

With inflation at its highest level in 41 years and energy prices skyrocketing, the cost of living crisis has dominated headlines since inflation began to creep up from historic lows in mid-2021. Following such an extended period of price rises, you may be concerned about your household finances and long-term plans. What is inflation? Inflation […]

Here’s a guide to your annual tax allowances, including ISAs, pension contributions and gifts – and why it’s important to make the most of them. At this time of year, one of the most beneficial things you can do for your money is to review your annual allowances. Make sure you’re using those that are […]

Key Dates For Your Finances 2023/24

Now’s the perfect time to make sure you’re fully prepared for the financial year ahead. To make it easy, we’ve summarised the key financial dates to put in your diaries: March Potential Spring Statement 31st – End of the Help to Buy Scheme – Buyers who applied for the loan have until this date to […]

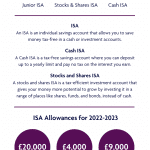

Are you making the most of your ISAs?

You are unable to carry any unused allowances over into the 2023-2024 tax year. If you are unsure on what ISAs are available to you and what they could do for you and your money, here’s how you can make the most of them. ISA An ISA is an individual savings account that allows you […]

In the 2022 Autumn Budget, it was revealed that the Junior ISA (JISA) spending limits would remain at £9,000 for the 2023/2024 tax year. The JISA limit was last changed in early 2020, when it was doubled from £4,500 to its current level. JISA and CTFs both benefit JISAs replaced Child Trust Funds (CTF) in […]

How to Create a Pension Plan for a Secure Retirement

A pension plan is an important part of saving for retirement. It can provide you with a regular income in retirement, which can be used to supplement other forms of retirement income such as private pensions and state pensions. In this blog post, we will discuss the different types of pension plans available and how […]

Planning for a comfortable retirement

Tina is a fit and vibrant 59-year-old who expected retirement to offer a whole new lease of life. She was looking forward to using her increased leisure time to explore Europe while indulging her passion for climbing. However, after going through her finances, she’s now concerned she won’t be able to afford her monthly bills […]

Is opting out of a workplace pension a false economy?

Rachel is a 35-year-old charity administrator. When she started her current job nearly six years ago, she was automatically enrolled into her workplace pension. Auto-enrolment for workplace pensions was introduced in the UK to encourage more people to save for retirement. It means employers have to enrol into a pension any workers who are: Not […]

Pension Planning for the Self-Employed

There are 4.8 million self-employed people in the UK and only a third have any kind of pension arrangement. A shocking statistic when you consider that State support is shrinking and we’re all living longer. Of course, saving for a pension when you’re self-employed is not as straightforward as it is for an employed person, […]

Pension lifetime allowance – how it affects you

In his 2021 Budget, the Chancellor announced a five-year freeze on the lifetime pension allowance. What does this mean for you and your retirement fund? What is the lifetime pension allowance? The lifetime pension allowance sets a limit on how much you can save in your pension before you start paying tax on anything over […]

Five practical reasons you should create a financial plan with your partner

Money and financial goals are still sometimes viewed as taboo subjects, even within relationships. If you’ve been putting off conversations about finances, creating a plan together could have many benefits. Actively talking about money can be positive for both you and your loved ones, and research suggests it’s something younger generations are more likely to […]

Cost of living crisis: Why you should review your budget and plans

The cost of living is rising. Reviewing your finances now is crucial for understanding what effect inflation could have on your lifestyle and long-term plans. Inflation was at an almost 40-year high. In the 12 months to August 2022, it was 9.9%. There are several factors contributing to rising inflation, including the conflict in Ukraine, […]

10 simple ways to cut your carbon footprint and reduce your energy bills

Reducing your energy consumption can be a great way to cut your carbon footprint, lessening your personal impact on the environment and potentially helping to limit the devastating effects of climate change. As living costs and the price of energy are soaring, taking action to lessen your usage can also be an effective tool to […]

Autumn statement 2022: what it means for you

After several months of economic and political uncertainty the new chancellor, Jeremy Hunt, has delivered his autumn statement. With announcements relating to energy bills, Income Tax, the State Pension, tax allowances, and Stamp Duty, there are plenty of ways your finances could be affected in 2023 and beyond. Here are the key points of the […]

What is a Standard Variable Rate Mortgage?

Sarah has never overstretched herself when it comes to money. After paying her monthly bills, she’s always had a bit left over. So, when her mortgage lender wrote to her to remind her that her five-year fixed-rate deal was coming to an end and that she needed to find a new deal or she’d be […]

How might rising interest rates affect your mortgage?

The Bank of England has raised interest rates and warned further hikes are likely in the coming months. This will mean bigger bills for some homeowners. On 3 November 2022, the Bank of England raised interest rates from 2.25% to 3% – the eighth hike since December 2021 – in a bid to combat soaring […]

Downsizing your property to raise money

Your current home may well be the place where some of your happiest memories were created. Realistically, however, downsizing may be an excellent way of financing many more. Here are some points you should consider on the topic. Why should I downsize my home? Home may be where the heart is, but property has a […]

Improving your chances of passing a mortgage affordability assessment

The covid pandemic put things into perspective for Deborah. Before hand-sanitizer and facemasks became the norm, she and her boyfriend were living in a pokey flat while they saved up to buy a place of their own. As the pandemic took hold, they were both furloughed and – for the first time in years – […]

Buy-to-Let Mortgages – What you need to know

Pete has just inherited £35,000 from his grandma and he’s thinking about investing in a buy-to-let property but has no idea where to start. So, what are the key things Pete needs to know? Is the buy-to-let market a good investment? Some of Pete’s friends have warned him that the buy-to-let market is still reeling […]

The Value of Mortgage Advice Part 2

With so many mortgage lenders offering their products on the high street and online, it can be tempting to cut out the middleman and ‘go direct’. When you’re making such a huge financial commitment, the guidance you can get from a qualified mortgage adviser can be invaluable. Here are five reasons we can make a […]

‘The Growth Plan’ – a further update

At 6.00 am on Monday 17 October, the Treasury issued a press release announcing that the (new) Chancellor, Jeremy Hunt, would making a statement “bringing forward measures from the Medium-Term Fiscal Plan”. The timing of the press release suggested that the Treasury was concerned it had not done enough the previous Friday to calm markets […]

Mortgage to Wealth – First Steps Into Investing

Taking Your First Steps Into Investing There is no right time to begin investing but there are some decisions to make that could affect your returns. If you are 7 years old and saving your pocket money for a PS5, 17 saving the money from your first job for a car, 27 saving for your […]

Could remortgaging help you beat the cost-of-living crisis?

Practically every penny of Mike’s monthly salary is accounted for so, as the cost-of-living crisis starts to bite, he’s worried about making ends meet. He’s started shopping around for cheaper deals on his broadband, mobile-phone contract, and car insurance, and he’s also cancelled his gym membership and a couple of his TV subscriptions. But he’s […]

What does the base-rate increase mean for you?

In a bid to tackle rising inflation, the Bank of England has increased the base rate for the seventh time since December 2021. The 0.5% hike takes the interest rate to 2.25% – the highest since November 2008, when the banking system faced collapse. So, what does this mean for you? Mortgages If you’re on […]

Talking to Kids About the Value of Money

After seeing their six-year-old son’s birthday list, Liz and Dan have realised it’s high time they started teaching Archie about the value of money. It’s true they both have reasonably well-paid jobs and only the one child but, even so, a Saint Bernard puppy, a quad bike, a horse and a life-size dalek don’t come […]

Lindsay and Sam have just found out they’re expecting their first baby. Although they’re excited at the prospect of starting a family, it’s come as a bit of a surprise and their current living situation is far from ideal. They’ve been staying with Lindsay’s dad in his two-bedroomed terrace for just over a year while […]

First time buyers guide to saving for a deposit

When preparing to buy your first home, saving for a deposit can be a difficult process. As house prices, inflation, cost of living and mortgage rates increase, it can mean that some mortgage lenders may require larger deposits of the property value. This can be challenging trying to save a large sum of money and […]

Home Insurance – What you need to know

One wet and windy evening, Rachel and Nathan decided to take advantage of their newborn, Eli, falling asleep in his moses basket by getting an early night. Gently picking up the basket from its regular spot in front of the fireplace, they crept upstairs. No sooner had they settled in bed when they heard a […]

Investing for your children’s future

As parents to four children ranging in age from three to 12 years old, Rachel and Samantha were horrified to hear on the news that a quarter of 20-to-34 year olds still live at home with their parents. As much as they love their kids, the idea they might still be a permanent fixture around […]

Saving for a university education

Funding your child’s university education Sarah and Andrew’s 10-year-old twins, Isabelle and Isaac, couldn’t be more different. While Isabelle is boisterous and full of beans, Isaac is gentle and reserved. The children do have one thing in common though – they’re both extremely bright and they already know exactly what they want to do when […]

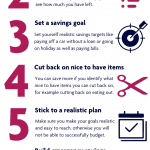

Budgeting tips for saving money while making your life better

Whether you want to go on holiday or just want to save some money for the future, budgeting is a good way to put aside some money for reaching this goal. Here you can find some tips to help you take control of your finances. Why is budgeting so important? You might think that it’s […]

What are value-added services?

Value-added services are benefits included in an insurance policy that you might not be aware of – but could help improve your overall health and wellbeing. When you take out an insurance plan like life insurance, critical illness, or income protection, you get the financial protection in the form of a payout, but there are […]

Holding steady through a sluggish forecast

Markets experienced some June gloom in the wake of further interest rate hikes and lower economic growth forecasts. Global growth is set to slow to 3% this year and 2.8% in 2023, according to the organisation for economic development (OECD). [1] The ongoing war in Ukraine has added to the slowdown, along with high inflation […]

10 ways to reduce your tax bill

Being tax smart means knowing the basics about how tax affects your life and money. Here are 10 ways to reduce your tax bill, which could make your money go further for you and your loved ones. Personal savings allowance You’re entitled to receive some interest on your savings tax-free every year, depending on your […]

What is business protection insurance and how does it work? Find out why it could be right for your business. If you own or run a small business, protecting it is always a priority, especially if something were to happen to a key member, which could affect the financial health of the company. In this […]

A remortgage is the process of moving your home’s existing mortgage to one with a new lender. Remortgaging could help you save money if you weigh up the fees involved with the savings you could make. Here’s how it works. People remortgage for many different reasons, including: Finding a better deal elsewhere – you might […]

We explore how Omnis appoints third-party managers to run funds to provide access the best investment talent in the market. Omnis Investments (Omnis) offers clients of The Openwork Partnership and 2plan Wealth Management a range of 26 funds. They appoint third-party investment managers, allowing investors access to the best talent in the market. No matter […]

Pension Planning For The Self-Employed

There are 4.8 million self-employed people in the UK and only a third have any kind of pension arrangement. A shocking statistic when you consider that State support is shrinking and we’re all living longer. Of course, saving for a pension when you’re self-employed is not as straightforward as it is for an employed person, […]

Shareholder/Partnership Protection

If you have a partnership business or one with multiple business shareholders (e.g. a private Ltd Company), have you thought about what might happen if something happened to one of you? This is where a Shareholder or Partnership Assurance Protection plan can help. If a shareholder in your private Ltd company or partner in your […]

Investment Update – A difficult patch for the global economy

Financial markets were unsettled in May as the effects of the war in Ukraine along with concerns over inflation and growth dominated investor sentiment. The International Monetary Fund (IMF) cautioned global finance leaders to expect multiple inflationary shocks in 2022 as markets continued to be unsettled in May amid fears of an economic downturn and […]

Things to avoid when investing

To keep your investments from losing value or slowing the growth of your assets, avoid these common investing mistakes. There are more risks and opportunities than ever for investors to navigate in today’s rapidly evolving markets. Here are four approaches we believe every investor should follow. Don’t pile into cash – stay invested The biggest […]

Make the most of your tax allowances by using the different types of ISAs that are available. Individual Savings Accounts (ISAs) were first introduced in 1999 and are a tax-free way to save into a cash savings or investment account. There lots of different types of ISA available, but the right one for you will […]

Chancellor Rishi Sunak used the Autumn Budget 2021 to invest taxpayer money in long-term plans he says will secure the economic future of the country. Everything from the NHS, schools, local transport and the culture and leisure sector appear set to benefit from the better-than-expected economic outlook from the Office for Budget Responsibility. But immediate […]

Get the best out of your BTL mortgage

Many fixed mortgage deals will be approaching the end of their term this October, so it’s a good idea to review your buy-to-let mortgage. With interest rates still at low levels and demand for rental properties increasing around the country, investing in a buy-to-let (BTL) is a popular choice for many. Buy to let basics […]

Can your pension sustain your retirement?

Working out how long your pension pot will need to last – as life expectancy rises – is worth thinking about sooner than later. The lockdown caused many people to reassess their lifestyles, which for some meant choosing early retirement. But what retirees have found is that pension pots are not matching the period of […]

You might be thinking about whether to invest in crypto currencies. We explain why it may not be the right choice, and how to better approach your portfolio. This year has been eventful for bitcoin, with the cryptocurrency reaching a record high and then almost halving in value all in the space of six weeks. […]

Investments or savings? What’s the best way to safeguard your child’s financial future?

When you see your child dressed up for school for the first time, it’s a stark reminder how quickly time flies. It might feel like only yesterday you were bringing them home from hospital or struggling through their first tooth, but when they walk through the school gates with their backpack and shiny shoes, you […]

Unlocking the value in your home

The number of people using equity release schemes fell last year as older homeowners grew more cautious. Older homeowners seemed to be more reluctant to release cash from their homes in 2020, according to the Equity Release Council. Data from the trade body shows drawdowns from lifetime mortgages fell by 21% last year and 10% […]

Should we be concerned about rising inflation?

Most economists expect inflation to pick up over the next few months as lockdown restrictions ease and shops and restaurants reopen. But is this a cause for concern? As lockdown measures begin to lift, financial markets are making their adjustments in anticipation of a rise in inflation, with bond yields picking up (meaning prices have […]

Protect your possessions with accidental damage cover

Insurance claims for accidental damage increased over the past year as more people worked from home, so it’s a good time to check your own coverage. Figures from some of the country’s biggest insurance providers have shown a sharp rise in claims of accidental damage during the lockdown. With many millions now working from home, […]