As a new year begins you may want a fresh start for you and your families’ health. Did you know that many insurance policies offer access to a range of health and wellbeing services that can help? You also don’t need to make a claim to use them as your protection...

Investing in Stocks and Shares ISAs

Investing in a Stocks and Shares Individual Savings Account (ISA) can be an excellent way of growing your wealth over the long term, providing the potential for higher returns compared to other forms of savings. This post aims to demystify stocks and shares ISAs,...

Some techniques to think about when you’re investing

Whether investing for the first time or looking to improve your approach, a good place to start is with the people who do this for a living. Here are four techniques the professionals follow that could help you become a successful investor. Think Long Term History...

Key dates for your finances in 2024

As we say goodbye to 2023 and welcome 2024, now’s the perfect time to make sure you’re fully prepared for the financial year ahead. To make it easy, we’ve summarised the key financial dates to put in your diaries: January 1st – New Energy Price Cap – The new energy...

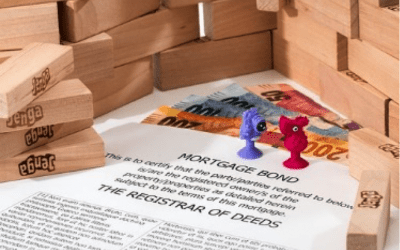

The essentials you need to know about credit checks before borrowing money

The information a lender finds during a credit check is important – it could affect whether you’re able to borrow money, including through a mortgage, and the interest rate you’re offered. Yet, they can also seem perplexing. Indeed, a Royal London survey found that a...

Is It Worth Building an Investment Portfolio in an Economic Downturn?

In the face of an economic downturn, many individuals are left questioning the wisdom of investing. The declining market values and financial uncertainties can make the investment landscape seem fraught with danger. However, building an investment portfolio during...

Cancelling your financial protection could be a dangerous way to save money

While the cost of living crisis may be putting a strain on your finances, read why cancelling your financial protection could be a dangerous way to save money Centuries ago, Benjamin Franklin said that... “By failing to prepare you are preparing to fail.” This is...

Five practical ways to protect your money during the cost of living crisis

With inflation at its highest level in 41 years and energy prices skyrocketing, the cost of living crisis has dominated headlines since inflation began to creep up from historic lows in mid-2021. While the Covid pandemic began the inflationary increase, this was...

Understanding Life Insurance: A Guide to Coverage Essentials

When it comes to safeguarding your family’s financial future, life insurance can be a valuable tool. It's a subject that might seem complex and even intimidating at first glance, but don't worry, we're here to make it easier for you. In this guide, we at Downton &...

What are value-added services?

Value-added services are benefits included in an insurance policy that you might not be aware of – but could help improve your overall health and wellbeing. When you take out an insurance plan like life insurance, critical illness, or income protection, you get the...